Indiana offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Indiana Energy Association

Indiana Energy Assistance Program

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Indiana Government

200 W. Washington St.

Indianapolis, IN 46204

(317) 233-5293

[email protected]

Monday – Friday, 9:00 a.m. – 3:00 p.m.

Duke Energy

2727 Central Ave

Columbus, IN 47201

(800) 777-9898

Monday – Friday from 8 a.m. to 5 p.m.

Indiana Office of Energy Development

One North Capitol Avenue

Suite 900

Indianapolis, IN 46204

(317) 232-8939

[email protected]

Monday – Friday

9:00am – 5:00pm, subject to change

Indianapolis Weather Bureau

6900 West Hanna Avenue

Indianapolis, IN 46241-9526

(317) 856-0664

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

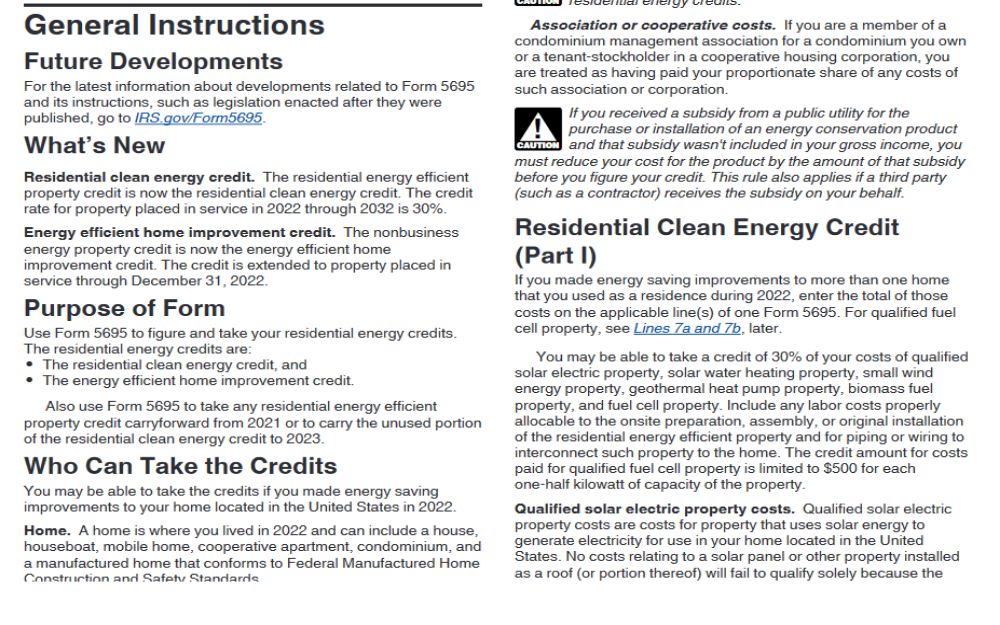

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Indiana Clean Energy Power

Solar and Wind Energy Ready Communities

Solar for All

Home Energy Rebates

Contact

Grants and Funding Opportunities

Indiana’s National Electric Vehicle Infrastructure (NEVI) Planning

Indiana’s Energy Policy

Power Outage Map

Office of Sustainability

City-County Building

200 E. Washington St. 2460

Indianapolis, IN 46204

(317) 327-4000

[email protected]

Monday – Friday: 9 AM – 5 PM

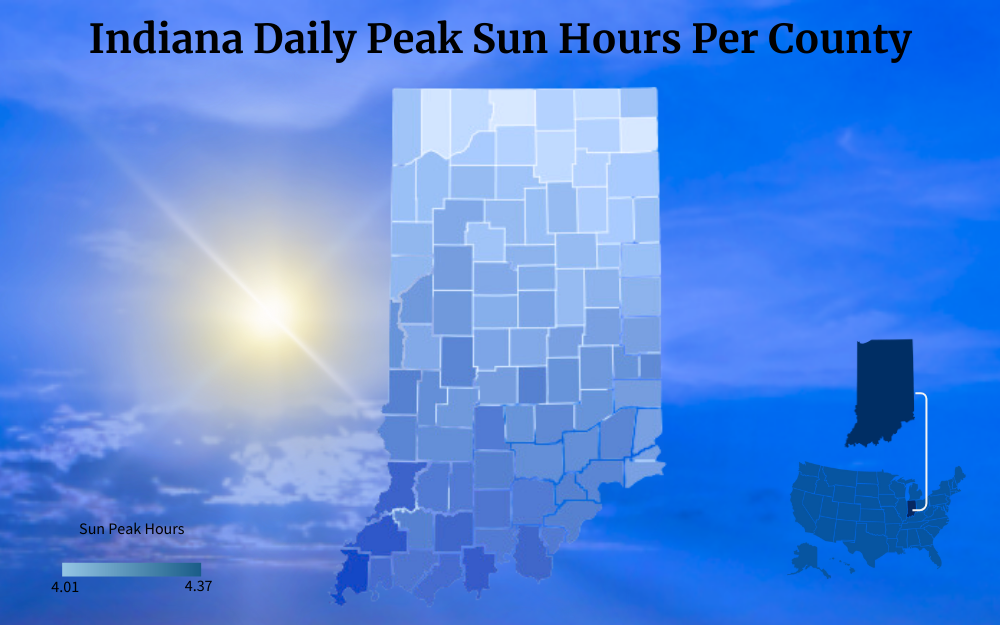

Indiana has an average of 4.5 hours a day of peak sunlight, which is enough glorious sunshine to empower photovoltaic arrays.

What Type of Credits Does Indiana Offer for Solar Power? (Solar ITC Forms for Indiana and Federal Tax Credits)

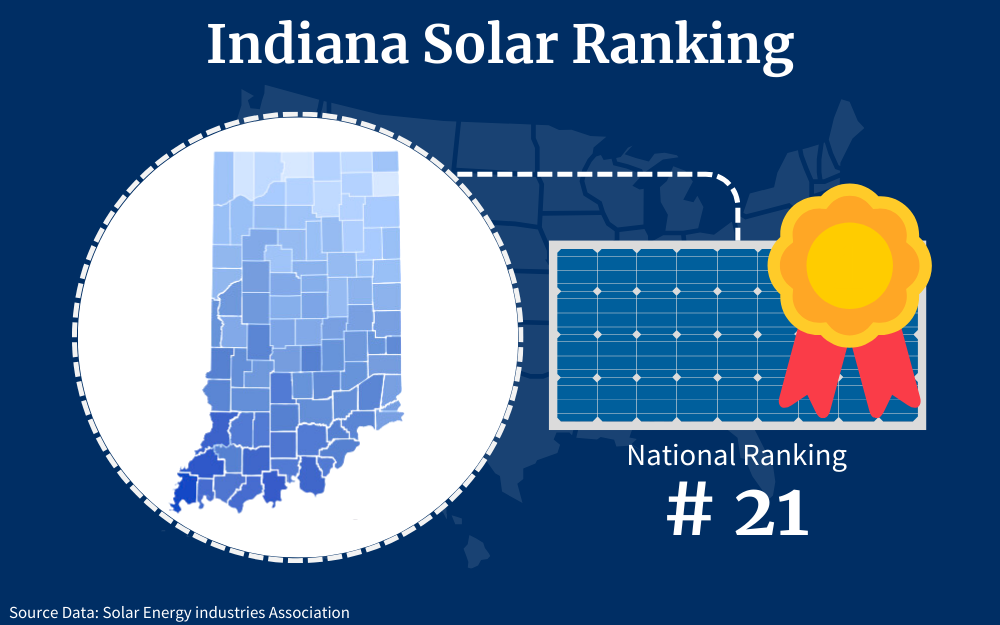

Where Indiana does falter when compared to other states, is the availability of financial incentives and programs that can be applied for by those residents ready to install a solar energy system on their property, ranking only 21 in solar adoption.

But, that doesn’t mean that there aren’t many enrollment and registration options for residents who want to switch to green energy options, you just need to know where to find them.

This guide provides detailed steps about Indiana solar incentives and how you can use them to save money on the cost of solar panels in the state, disconnecting from the grid and lowering your energy pries.

Installing solar panels in Indiana is more expensive than in other states, often ranging between $21,780 and $36,300 before any Federal solar tax credits or state rebates are deducted.9

On a Federal level, there is help in the form of the ITC program that has been in operation since 2006. The program has helped millions of Americans in their desire to adopt solar energy for both their homes and their businesses.

It was due to be phased out in 2022 but was extended by President Joe Biden under the Inflation Reduction Act due to its popularity.

The Federal Solar Tax Credit

Originally called the Solar Investment Tax Credit (ITC), the name was changed to the Federal Solar Tax Credit and then more recently to the Residential Clean Energy Credit, but it is still commonly referred to as the ITC.

There can be no doubt that the influence the initiative has had on the solar industry has been significant, boosting the growth of solar panel installations and solar energy generation across the country by at least 200 times from what it once was in 2006.10

The reason why it is so valuable is the 30% tax credit that can be claimed by anyone who has installed a photovoltaic system. It is by far one of the most progressive initiatives in the industry and is open to a wide section of the population, but not everyone will be able to get it.

To claim the tax break, certain criteria have to be met.

- The property where the solar power system will be installed must be owned by the applicant and located in the United States.1 The property itself can be a condo, mobile home, or even a houseboat as long as it is used as a residence.

If you are the owner of multiple properties (residential property and vacation home) and have installed solar panel systems on both, you will not be entitled to the tax credits on the two properties. You can claim on either the solar panel installation on your residential property OR on your vacation home.

However, if you are renting out the vacation home, you may be able to claim the ITC for businesses. As a result, you are still eligible to claim the residential ITC.2 - If you are renting the property you will not be eligible, only the title holder on the deeds can make the claim.

Some renters have convinced their landlords to take advantage of the ITC offer by agreement to a rental increase to partially or fully cover the extra expense. The owner benefits from an increased property valuation and his tenant gets cheaper electricity bills.

A win-win situation. So even if you are just renting, all is not lost as long as you have a flexible landlord. - You also have to be the owner of the system. Many solar companies offer leasing or rental contracts, but under either agreement, the tax break will not be eligible to be claimed.

The system doesn’t have to be cash-bought, however, a bank loan contract would be sufficient proof of ownership. - To claim the 30% tax break you have to owe taxes in the first place. For a solar system costing $28,000, $8,400 can be saved when the 30% is applied.

If your taxes for the year are $9,000, for example, you would only have to pay $600 after the deduction. But don’t panic if your taxes are only $2,500, you won’t miss out.

The credit is available for 5 years and can be levied against your tax liabilities for that extended period of time, and could look something like this:

- First year’s taxes of $1,900 would leave a credit balance of $6,500

- Second-year taxes of $1,800 would leave a credit balance of $4,700

- Third-year taxes of $2,200 would leave a credit balance of $2,500

- Fourth-year taxes of $1,400 would leave a credit balance of $1,100

- Fifth-year taxes of $2,000 would leave a tax bill due of $900

The 30% tax credit is open to anyone who owns their own home and has a tax liability.

But you may be wondering, what happens if the tax credit is more than I owe, will I get a refund? Unfortunately, not.

After the five-year rollover period has ended, any credits remaining will not be able to be claimed in year six.

Homeowners purchasing newly constructed properties need not be left out either if the new property already has solar panels built in. They can also participate as legal owners of the property and the solar system and are eligible to claim the ITC in the year of moving in.

The ITC will continue until the end of 2032 at the same discounted level of 30%, and then in 2033, that amount will be reduced to 26%. The following year, only a reduced 22% will be available, finally dropping down to 0% when the initiative is terminated in 2035.

Your solar photovoltaics installer will guide you through how to fill in the IRS Form 5695 to claim the credit as they will have to provide all the information on solar power panel’s rating,2 location, cost, and other pertinent information.

Here are the steps in filling out IRS Form 5695:15

Step 1: Obtain the form

You can download Form 5695 from the official IRS website or request a paper copy from the IRS.

Step 2: Read the instructions

The IRS provides detailed instructions for filling out Form 5695.16 It’s essential to read these instructions thoroughly before you begin to ensure you understand the requirements and eligibility criteria.

Step 3: Submit your tax return

File your complete tax return, including Form 5695, by the due date (usually April 15th, unless extended). You can file electronically or by mail.

Step 4: Review your work

Before submitting your return, double-check all the information on Form 5695 to ensure accuracy.

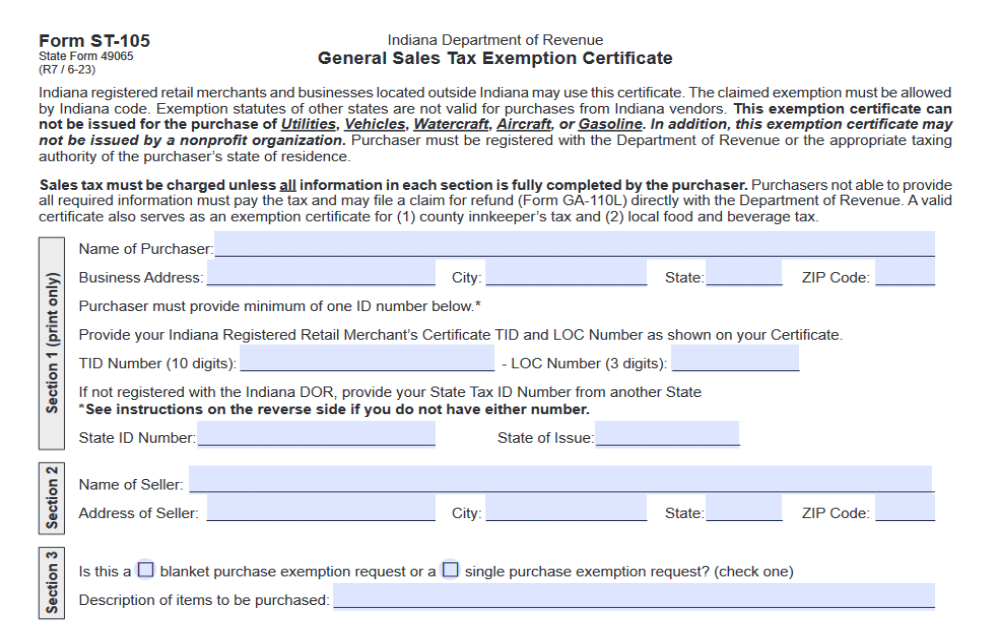

Indiana Solar Sales Tax Exemption

This is one solar program that saves money immediately when the time comes to buy solar panels as sales taxes on photovoltaic systems have been exempted.

But you need to understand how it works.

Equipment used in the generation of renewable power in Indiana was not actually exempt from sales taxes until a ruling by the Indiana Department of Revenue (DOR) was issued in 2014.

This was an extension of a 2009 statute for wind turbines that stated that if the equipment was used primarily for generating renewable electricity for personal or commercial use it would be sales tax exempt. Solar panels fall into this category.

Anyone claiming the exemption would have to give the Indiana solar seller a properly completed copy of the Indiana General Sales Tax Exemption Certificate, Form ST-105.17

Take the time to fill out this form with your solar provider because a discount of 7% from the sales tax exemption will save you nearly $2,000 on a $28,000 system.

Renewable Energy Property Tax Exemption

With the attention given to the effects of climate change, renewable energy projects, both residential and commercial, are being encouraged and subsidized like never before.

It has been calculated that installing a rooftop photovoltaic system may raise the value of your home by 4%. Projects such as roof replacements or extensions also increase the value but do not fall into the exemption category.

The Lawrence Berkeley National Laboratory of the U.S. Department of Energy performed the largest-ever research on homes fitted with rooftop solar panels between 2002 and 2013.3

It included 8 states, and at the conclusion of the trial in 6 of those states, it was found that those solar-enhanced properties could be sold for about $15,000 more than equivalent properties without them.

The actual increased value of your property would have to be assessed, and that added value would be exempt from property taxes. That increased valuation would be included in the sale price of the property if it were to be put on the market.

This exemption is not just applicable to year one. Every year that the system is operational, you will qualify for the property tax exemption.

It is only open to property owners, not renters, but it does cover mobile homes and other types of living accommodations fitted with renewable solar panel energy systems.

Property owners who want to apply for this exemption should fill out Form 18865 and submit it to the local county auditor. The local auditor or assessor should be contacted about this incentive to confirm eligibility, or if you have any questions.

South Central Indiana REMC: Residential Energy Efficiency Rebate Program

This rebate is designed to reduce the emissions from older home heating and cooling systems.

Indiana will provide rebates and credits for :

- Geothermal Heat pumps

- Water Heaters

- HVAC tune ups

- Split Heat pumps

To register, you can obtain up to 2 rebates a year, and comply with the conditions outlined for the credits.

Home Energy Performance-Based and Whole-House Rebates (HOME)

Thanks to recency federal funding, Indiana offers rebates for energy efficiency updates that residents make to outdated appliances and other home improvements.

These homeowner incentives help reduce energy use, and can put money in your pocket thanks to EERE programs.

How Solar Credits Work With Taxes

Solar tax credits are a powerful inducement for any homeowner who wants to install solar panels, reduce their utility bills, and save money on their taxes.

With the solar tax credit, you are able to deduct some of the money you spend on a solar energy system from your taxable income.

ITC (The Federal Solar Tax Credit)

A tax credit of 30% is levied against your taxes owed, and if your taxes don’t equal the percentage of the sale price of your system, the amount of taxes due is deducted from the total, and the balance is rolled over.

You will not get a check in the post for the balance, however, if there are any credits left over.

If your tax credit exceeds your tax liability, you may carry the excess to the following year. This rollover will continue for 5 years or until the credit is used up, whichever comes first.

Any remaining credit after this time will be lost to you, unclaimable against any future tax liabilities.

The typical solar installation may save taxpayers up to $7,500 in taxes, according to the U.S. Department of Energy.11

Other states have programs that work along similar lines to the ITC, but Indiana is not one of them. As the industry is always in flux, your solar installer will be able to update you if there are any changes.

Does Indiana Offer Net Metering and Power Purchasing Agreements (PPA)?

Rooftop solar, according to activists in Indiana, has become costly for all but the wealthiest users as a consequence of a law passed in 2017.

Meanwhile, the utility providers maintain that they are ensuring no other customers’ power costs go toward funding the system.

Net Metering

To put it simply, net metering allows you to sell any excess energy produced by your solar system back to your utility company via a grid-connected system.1 Every kilowatt hour (kWh) that leaves your property is credited to you, and those kWh are pumped back into your building if and when you have a power shortage.

A smart meter put in your house can automatically collate all of the solar usage information, including your solar consumption, and it can help both you and your power supplier at peak periods.

The state of Indiana used net metering effectively up until 2018, but that all changed with the passage of SEA 309 in 2017. Any new solar property owners in Indiana who are supplied by the principal power suppliers are thus no longer eligible to participate in net metering.

Those who enrolled in the program before December 31, 2017 will be able to stay a part of it until July 1, 2047.

Another thing to take note of is that if an existing net metering customer’s successor in interest wishes to continue with the net metering service, they may do so. However, the service will only last until 2032.

Net metering is still an option for those who get their electricity from a municipal utility or a rural electric member cooperative, even if the rates they charge are among the highest in the nation.

With these changing policies on net metering, a possible alternative solution is a Power Purchase Agreement (PPA).

Power Purchasing Agreements (PPA)

A PPA is a 10- to 20-year agreement between you, the consumer, and generally a solar installation company.

The placement of the solar system might be on your property, with grid-delivered power flowing to your property, or it could be off-site, with energy transmitted to your home through the electrical grid.6

In either case, the third party pays for the installation and maintenance of the equipment while claiming all tax advantages and incentives.

For the period of the contract, the power is acquired at a lower set price than what you would get from the grid, and the third party profits from the price they negotiated with the utility provider.

Many consumers have speculated if it was possible to get free government solar panels, or are solar panels free in Indiana. It’s not, but this subscription model of going solar enables you to have a PV system fitted in your home with possibly no initial deposit and, just as importantly, hassle-free.

Current Solar Power Costs and Materials

If not for the ITC and local solar options to mitigate the costs, installing rooftop solar panels would be unaffordable for millions of homeowners in Indiana, especially considering the average cost of solar panel installations.

There are solar power plans and configurations that can affect the overall cost but these components are unavoidable basic materials needed for a rooftop solar installation.

- Types of solar panels

- Inverters to change the DC current into AC4

- Monitoring equipment to display energy generation and detect any faults in the system

- Racking frames to support the solar panels

- A Junction box that connects all the separate components

- A battery bank for energy storage

- A Charge controller to regulate and control electricity surges and prevent overcharging to a battery

- A solar tracker is an optional device that follows the arc of the sun for maximum solar absorption throughout the day.

- A meter to record the electricity produced

- A lot of cables

Solar Calculator: How Much Can You Save?

Before purchasing a photovoltaic system, it is possible to estimate how much you can save on your monthly utility bill by the use of online solar calculators.

This handy solar system calculator can provide a rough estimate of your potential lifetime savings from switching to solar energy, calculate the optimal size of your solar array, reveal potential financing alternatives, and determine the time until you break even on your investment.

Your home’s energy needs will dictate how many solar panels you’ll want to install. You’ll need to know the average monthly and annual power costs for your home in addition to the number of hours of direct sunlight per day in your state to get an accurate estimate.

Indiana has an average monthly power use of 946 kWh or 11,352 kWh yearly, and an average of 4 hours of peak sun every day.12

With an average solar panel size of 400 kWh, this formula can be used to calculate how many panels your home would need to satisfy your energy requirements. But always multiply the final figure by 25% to allow for discrepancies between real-world weather conditions for solar panel ratings compared to perfect factory environments.

946 (monthly kWh use) / 120 (monthly peak sun hours) = 7.88 kWh system

7.88 X 1,000 is 7,800W

7,800 / 400 (panel kWh) = 19.5 or (20 solar panels to cover the entire electricity consumption)

20 x 25% = 24 solar panels

The solar estimate for your panels and the potential payback time may be determined with the use of a solar power calculator, like the one provided below.

The payback period for a solar system in Indiana is about 12 years and in that time frame,13 you should expect annual savings of approximately $800.

How long solar panels last after that? Typical product lifespans for solar products are between 30–40 years.

Many experts believe half a century is possible and are working towards this goal of extending the average lifespan of solar panels.5

However, the amount of solar energy that is absorbed and converted into usable electricity after a PV system has been in operation for 25 years with the solar energy efficiency not being what it once was about this time, and an upgrade becomes necessary.

Using Photovoltaic Cells in Indiana for the Solar Grid

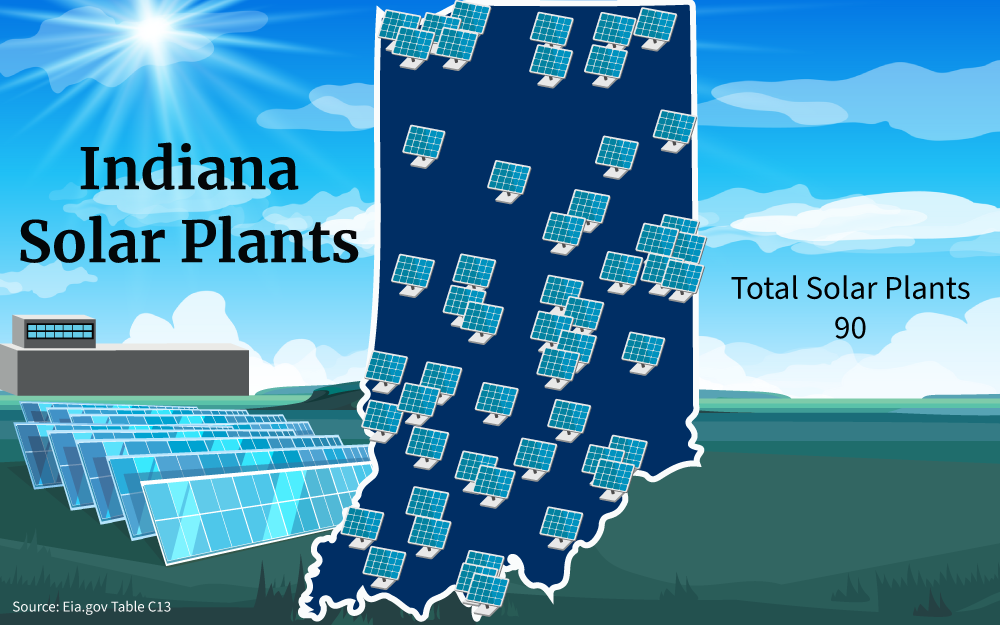

Unlike California which has close to 2,000 solar companies, Indiana residents have just 78 to choose from.14

That makes the selection process easier, yet for sure you still don’t want to be wasting time wading through dozens of quotes.

To narrow down the field, do some online research and eliminate those that do not measure up.

- Always ask how long the company has been in business. The longer the better as this proves that they will be around for the foreseeable future.

- Ask them if their installers are North American Board of Certified Energy Practitioners.

- Ask for references from previous customers in the last 6 months and the last 6 years at least. This will give you an idea of the quality of their work and their after-sales service.

- Ask if they offer PPAs, leasing, financing, or even renting options.

- Do they have all public insurance in case something goes wrong whether to your property or the panels during installation?

- How comprehensive is their warranty, and how long does it last?

- Ask them what they do with their solar panel waste as you’ve heard about some negative effects of solar panels. Do they recycle or just throw them away when replacing solar panels from an older property?

- Do they sell used solar panels? Just because a solar panel’s efficiency output is not at its brand-new level, the amount of electricity it generates may still be OK for your homestead.

- Do a solar panels comparison test to determine the quality of the solar system. If the price quoted seems too good to be true, it probably is.

- Always make sure you’re getting quoted like for like, and not for an inferior panel against a far premium one from their competitor to make their offer seem more attractive.

It’s important to take your time and make sure the solar panel vendor you hire is in compliance with all applicable laws and local regulations and is able to provide you with a first-class product and an excellent after-sales service if needed.7

Being able to save money on utility bills is often an impetus for homeowners in America to consider going solar.

Taking advantage of Indiana solar incentives and other renewable energy rebates can help you lower the cost of energy for your home and reduce the up front costs of installing a home solar system in Indiana.

Frequently Asked Questions About Indiana Solar Incentives

How Do Solar Panels Help the Environment in Indiana?

The increasing use of solar panels to generate electricity in Indiana is reducing the reliance on fossil fuels that were previously burned to create electricity, reducing local greenhouse gas emissions and the effects of climate change across the planet. This change illustrates how do solar panels help the environment.

Is There a Reason Why Solar Energy Is Bad?

The initial process of making solar panels has led some to question why solar energy is bad due to its initial carbon footprint. Indiana is serviced by several large recycling companies to repurpose outdated panels so they do not end up in landfills, a situation that has also contributed toward solar panels having a bad rep in the past.

Does Solar Energy Cause Pollution?

Solar energy is a clean power source, and when asking, does solar energy cause pollution, the answer is no, it does not produce any pollution. It has a small carbon footprint at the manufacturing stage and when it is discarded, but that is constantly being mitigated by management practices specifically designed for end-of-life photovoltaics.8

References

1Kaiser, C. (2018, January 26). Solar Power. Pennsylvania State University. Retrieved September 1, 2023, from <https://sites.psu.edu/kaisercivicissues138/2018/01/26/solar-power/>

2Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy Efficiency & Renewable Energy. Retrieved September 1, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

3U.S. Department of Energy. (2023). U.S. Department of Energy (DOE). Grants.gov. Retrieved September 1, 2023, from <https://www.grants.gov/learn-grants/grant-making-agencies/department-of-energy.html>

4United States Agency for International Development. (2023). Inverters. United States Agency for International Development. Retrieved September 1, 2023, from <https://www.usaid.gov/energy/powering-health/system-components/inverters>

5Case Western Reserve University. (2018, November 6). Making solar panels that last half a century. Case Western Reserve University. Retrieved September 1, 2023, from <https://thedaily.case.edu/making-solar-panels-last-half-century/>

6Martinez, P. D., & Gribkoff, E. (2022, May 24). The Electric Grid. Massachusetts Institute of Technology. Retrieved September 1, 2023, from <https://climate.mit.edu/explainers/electric-grid>

7Pennsylvania State University. (2022, July 8). How to Choose a Solar Panel (Photovoltaics) Vendor. PennState Extension. Retrieved September 1, 2023, from <https://extension.psu.edu/how-to-choose-a-solar-panel-photovoltaics-vendor>

8Solar Energy Technologies Office. (2023). End-of-Life Management for Solar Photovoltaics. Energy Efficiency & Renewable Energy. Retrieved September 1, 2023, from <https://www.energy.gov/eere/solar/end-life-management-solar-photovoltaics>

9Aggarwal, V. (2023, May 1). How much do solar panels cost in 2023? Energy Sage. Retrieved September 12, 2023, from <https://www.energysage.com/local-data/solar-panel-cost/>

10U.S. Energy Information Administration. (2023). Electricity Data Browser. EIA. Retrieved September 12, 2023, from <https://www.eia.gov/electricity/data/browser/>

11Solar Energy Technologies Office. (2022, September 8). Solar Investment Tax Credit: What Changed? Office of Energy Efficiency & Renewable Energy. Retrieved September 12, 2023, from <https://www.energy.gov/eere/solar/articles/solar-investment-tax-credit-what-changed>

12U.S. Energy Information Administration. (2022, October 5). 2021 Average Monthly Bill- Residential. EIA. Retrieved September 12, 2023, from <https://www.eia.gov/electricity/sales_revenue_price/pdf/table5_a.pdf>

13Energy Sage. (2023, September 9). Indiana solar panels: local pricing and installation data. Energy Sage. Retrieved September 12, 2023, from <https://www.energysage.com/solar-panels/in/>

14Solar Energy Industries Association. (2023). Indian Solar. Retrieved September 12, 2023, from <https://www.seia.org/state-solar-policy/indiana-solar>

15Internal Revenue Service. (2023). Form 5695. IRS. Retrieved September 13, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

16Internal Revenue Service. (2023). Instructions for Form 5695. IRS. Retrieved September 13, 2023, from <https://www.irs.gov/pub/irs-pdf/i5695.pdf>

17Indiana Department of Revenue. (2023). Sales Tax Forms. Indiana Department of Revenue. Retrieved September 13, 2023, from <https://www.in.gov/dor/tax-forms/sales-tax-forms/>

18Photo by Indiana Office of Energy Development. State of Indiana. Retrieved from <https://www.in.gov/oed/>